Shimao Property 813 Interim 2016

Published on August 31 2016

1H 2016 (English)

1H 2016 (Chinese)

From the report : In some third- and fourth-tier cities, the real estate market remained sluggish due to high inventory and weak demand. The divergent market performance rendered it a normal industry practice to have differing policies being applied in different cities. As such, in the first half of the year, the Group continued to adjust the timing and structure of supply by strictly adhering to the principle of “sales-based production” in third and fourth-tier cities and focusing on first- and second-tier cities. Looking forward to the second half of 2016, it is expected that demand will remain stable in the real estate market in general; supply-side structure reform will remain the focus; and monetary policies together with the overall easing policies of the real estate sector will maintain.

Inventory-to-sales ratio increased by 19%. With respect of inventory sales strategy, pricing was strategically adjusted to boost the sales of inventory in third- and fourth-tier cities with relatively low demand, with particular focus on pricing adjustments for longer aged inventories. As a result, a strong business foundation was laid by optimizing the inventory structure, increasing the cash collection ratio and enhancing the competitiveness.

In the first half of 2016, there was a trend of developers re-steering their focus on first and second-tier cities, causing fierce competition for land resources, soaring land prices and in turn many cases of “land king lots” transacted at exceptionally high prices, and thus continually squeezing future gross profit of the industry. The Group upheld its prudent strategy and adopted a more cautious approach in replenishing land reserves. In the first half of 2016, the Group acquired land reserves of 1.10 million sq.m. (before interests) in Fuzhou, Yinchuan, Beijing, Nanjing and Wuhan. Currently, Shimao Property has 116 projects with a total area of 31.85 million sq.m. (attributable interests) of quality land in 41 cities in China.

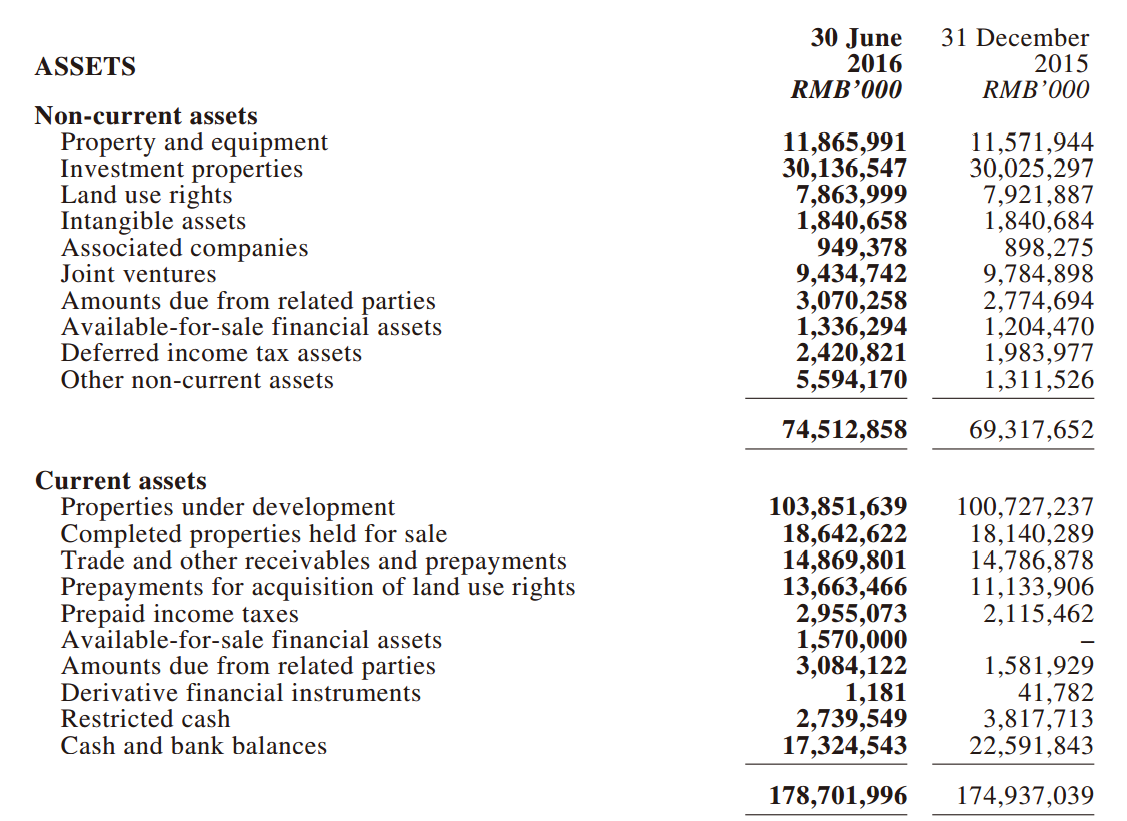

As of 30 June 2016, net gearing ratio of the Group was 55.7%. Net gearing ratio has been maintained below 60% for more than 4 consecutive years. Weighted average financing costs was 6.5% in the first half of 2016, a drop from the annual figure of 6.9% in 2015. The proportion of foreign currency borrowings for the full year is expected to drop further down to below approximately 32%. Moreover, the Group properly used financial derivatives including forward exchange option contracts to hedge against future RMB depreciation risks.

Announced on 14 March 2016 that it would transfer its entire or certain equity interests in the project companies for three commercial property projects, namely, Shenzhen Qianhai Shimao Financial Centre, Hangzhou Shimao Wisdom Tower and Nanchang Shimao APM, to Shanghai Shimao Co., Ltd., specifying that Shimao Property will be primarily engaged in residential property and hotel investment, development and operation in the PRC in the future while Shanghai Shimao will be primarily engaged in commercial property investment, development and operation. In addition, the transaction will also facilitate the release of asset value and improvement of Shimao Property’s cash flow.

In May 2016, Shanghai Shimao disposed of 100% equity interest in Beijing Fortune Times Property Co., Ltd. and Beijing Baiding New Century Business Management Co., Ltd. to Leshi Holdings (Beijing) Co., Ltd. at a consideration of approximately RMB2.972 billion according to the agreement. The share transaction generated profit after taxation attributable to shareholders of approximately RMB630 million, fully reflecting the strategic mindset of Shanghai Shimao in managing assets of commercial properties.

To demonstrate our appreciation for our shareholders’ unstinting support, the board of directors of the Company (the “Board”) has declared the payment of an interim dividend of HK26 cents per share for the six months ended 30 June 2016. The Board also declared the distribution of a special dividend of HK6 cents per share. The Group’s repurchase of a total of approximately 39.99 million shares in July also raised the value of its shares, uplifted the return on equity and rewarded the support from the shareholders. In April 2016, Fitch promoted Shimao Property’s long-term rating and debt rating from “BB+” to “BBB–”, which is an investment-grade rating.

Direct operating costs for hotels, commercial properties and others 614 million.

Property Investment

With respect to commercial properties, Shimao Property develops commercial properties through Shanghai Shimao, a 58.92%-owned subsidiary, which is primarily engaged in the development and operation of commercial properties.

Shanghai Shimao started the preparation of the non-public issue of its A shares for 2016 in March, under which not more than 1,063,149,021 shares (adjusted) would be issued to raise a total of not more than RMB6,670,442,700 (inclusive), for the acquisition of 51% equity interests in Shenzhen Qianhai Shimao Financial Centre, 100% equity interests in Hangzhou Shimao Wisdom Tower, 100% equity interests in Nanchang Shimao APM, and project development works.

Hotel Operations

As of 30 June 2016, the Group had 14 hotels in operation. Hotels which are planned to commence operations in the second half of 2016 include Conrad Xiamen, Double Tree by Hilton Ningbo Beilun, Mini Max Premier Hotel Dalian Jinzhou (self-operated), Mini Max Hotel Xiamen Central (self-operated) and Mini Max Premier Hotel Chengdu City Center (self-operated). In the first half of 2016, the Group’s hotels achieved revenue of RMB667 million, representing a year-on-year increase of 6.9%.

During the period under review, the Group recorded aggregate fair value gains of approximately RMB1,276 million (1H 2015: RMB820 million), mainly contributed by further increase in value of certain investment properties. Aggregate net fair value gains after deferred income tax of approximately RMB319 million recognized was RMB957 million (1H 2015: fair value gains after deferred income tax was RMB615 million).

Profit Attributable to Shareholders

Profit attributable to shareholders for the period decreased by 14.9% mainly due to the additional exchange losses of approximately RMB400 million. The profit margin from core business attributable to shareholders was 12.9% in the first half of 2016.

集團於東涌的酒店項目,及九龍的豪宅項目,需在 2019 年才開業和開賣,預期九龍項目較大型,需分五、六年推售。

就世茂房地產和世茂股份兩大平台的整合問題,許世壇透露,目前世茂房地產手上還有十餘個商業項目,未來會考慮放到世茂股份這一平台,畢竟 A 股的估值要比香港高。但其也強調,該部分資產一定要有溢價,世茂房地產才會轉手。

展望下半年,可出售總面積約為 687 萬平方米。在輕資產運營,世茂酒店及度假村已於 7 月簽署了首家委託管理輸出酒店-臨沂濱河世茂睿選酒店,並預計於 2017 年中對外營業。這亦標誌著世茂酒店及度假村“輕資產”戰略轉型的落地。

中國社會科學院財經戰略研究院、社會科學文獻出版社等日前發布的《流通藍皮書:中國商業發展報告(2016-2017)》 : 未來5年,中國的商品交易市場將有 1/3 被淘汰,另有 1/3 將轉型為批零兼有的體驗式購物中心,還有 1/3 將成功實現線上與線下對接。

《報告》認為,商品交易市場的發展承受著來自購物中心、超市、專賣店、便利店等新興業態的衝擊,特別是電子商務等各種商業模式的衝擊。根據《報告》,北京、上海、廣州、杭州等地有數十家百貨店在 2015 年關門。

此外,購物中心也面臨關門潮。目前,中國有購物中心近 4000 家,是美國的 3 倍之多。根據中國購物中心產業諮詢中心預測,從現在到 2025 年,還會有 7000 家購物中心建成開業,屆時中國內地的購物中心將超過 1 萬家。而目前運營的購物中心有一半面臨著經營困難,有近千家面臨著停業調整、倒閉的風險。

/image%2F1092704%2F20170423%2Fob_25e5a7_p1040287-1-3.jpg)

/http%3A%2F%2Fassets.over-blog.com%2Ft%2Ftwentyeleven%2Fimages%2Fpine-cone.jpg)